📍 Premium Strategy Overview

The Premium strategy takes advantage of funding rate differences across multiple exchanges.

It typically involves entering LONG/SHORT positions on different exchanges to capture funding rate gaps while hedging against price movement, aiming for risk-free returns.

By combining price differences and balanced position sizing, you can earn funding profits without directional risk.

📘 How It Works

- Funding fees are paid every 8, 4, or 2 hours depending on the exchange. Both the timing and rates vary by platform.

- If Exchange A offers +0.5% and Exchange B offers -0.5% with 10x leverage, you can potentially earn a 10% return.

- Positions are balanced either by equal size or leverage ratio to hedge against price volatility.

- By holding the positions until the funding payout time and then closing them, you can secure the funding profit from each exchange.

🔧 Execution Steps

- Open a futures account and deposit funds on a global exchange (Binance, Bybit, OKX, Bitget, Gate.io) by transferring assets from a domestic exchange.

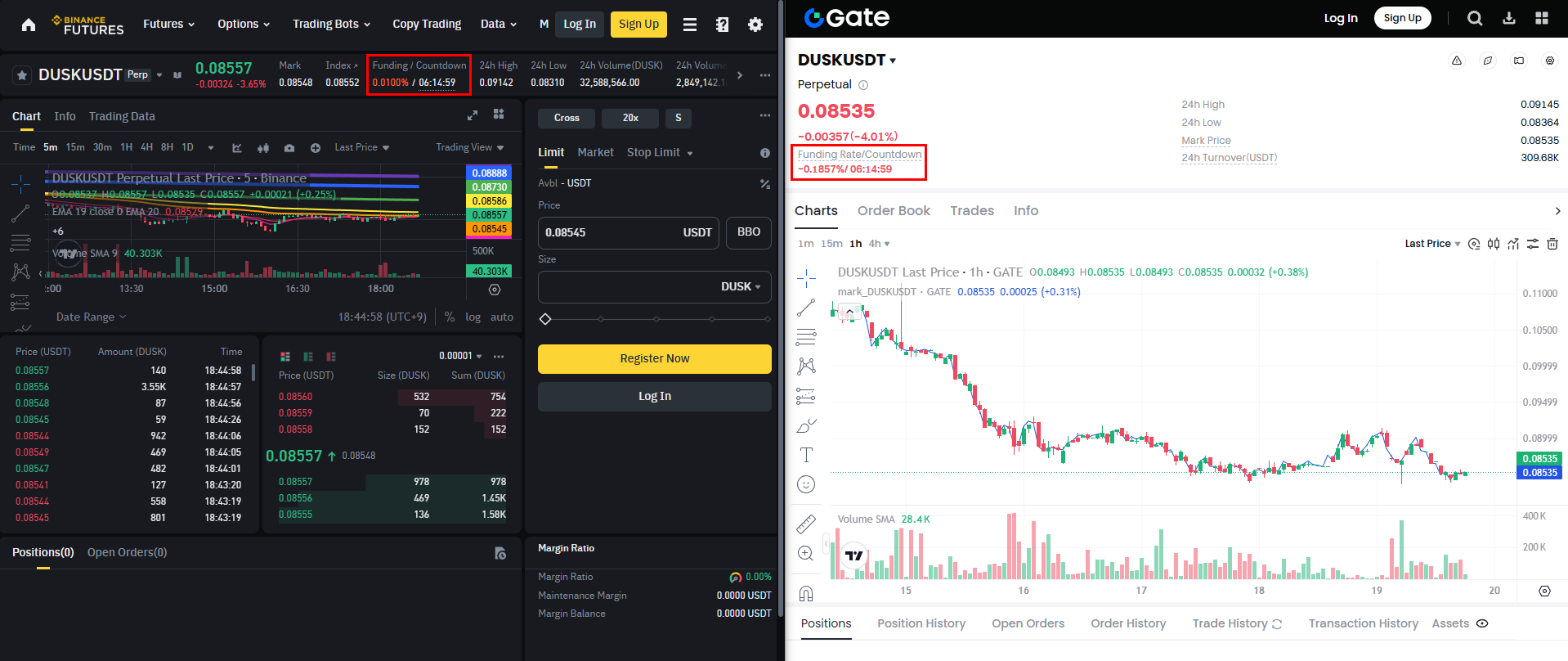

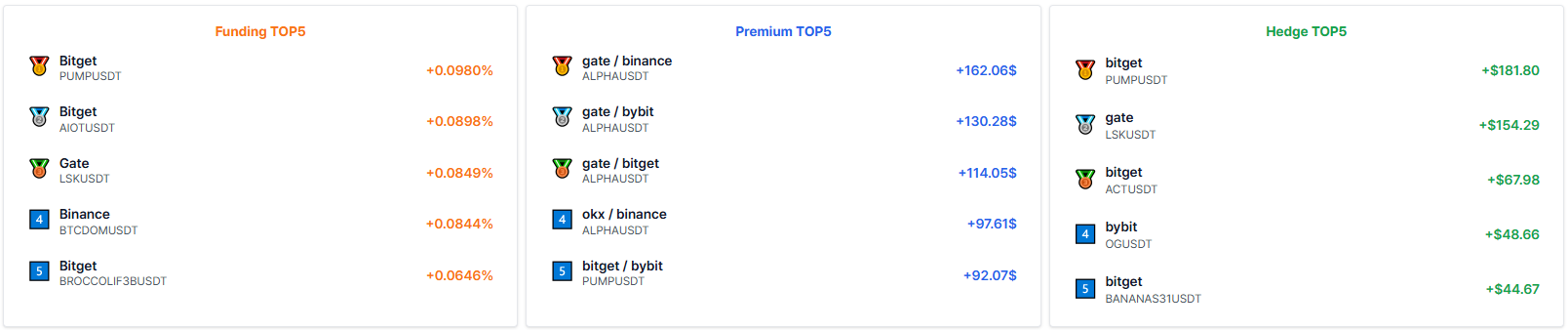

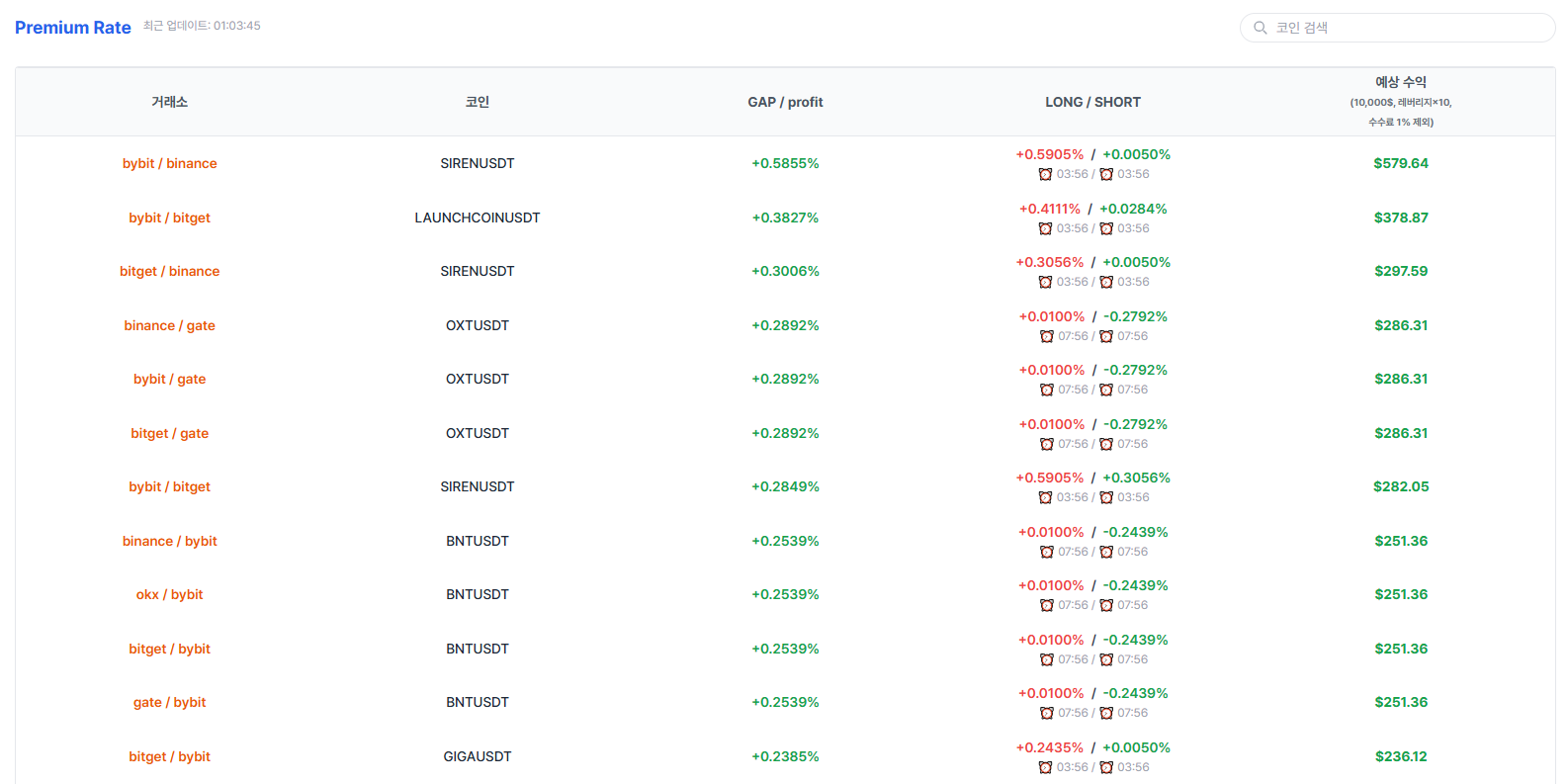

- Check the Premium page or the Premium Top 5 section to find favorable funding opportunities.

- Enter positions on both exchanges showing a premium difference. (To minimize risk from funding rate changes, it's recommended to enter closer to the funding payout time.)

- If the premium is -0.5% / +0.5%, go LONG on the -0.5% exchange and SHORT on the +0.5% exchange.

- If the premium is -0.5% / -0.1%, go LONG on the -0.5% exchange and SHORT on the -0.1% exchange.

- If the premium is +0.5% / -0.1%, go SHORT on the +0.5% exchange and LONG on the -0.1% exchange.

- If the premium is +0.5% / +0.1%, go SHORT on the +0.5% exchange and LONG on the +0.1% exchange.

- You can check the suggested position direction by color on the Premium page or Premium Top 5 section.

- In the Premium sections, red indicates a favorable SHORT entry, and green indicates a favorable LONG entry.

- Set your leverage carefully—higher leverage increases liquidation risk, so adjust accordingly.

- Coins with low trading volume may not fill your order at the intended size. Always check the order book and volume before entering.

- At the funding payout time, close both positions simultaneously to collect the funding profit.

- If the premium trend is expected to continue, you may choose to hold the positions longer.

- However, since MWHLabs focuses on minimizing risk, we generally recommend closing positions after funding is received.

🚀 Recommended Use Cases

- Maintain equal LONG and SHORT positions on the same coin to minimize directional risk (see Premium page).

- Open a SHORT position on the exchange with a higher funding rate and a LONG position on the exchange with a lower rate to profit from the funding gap (see Premium page).

- Combine spot and futures positions to pursue risk-free returns through hedging (see Hedge page).

⚠️ Important Notes

- The estimated return on the Premium page excludes 0.8%, which is calculated as 0.2% maker fee × 4 cycles.

- Be sure to factor in network fees and exchange fees when calculating your actual returns.

- Temporary trading halts or low liquidity on one of the exchanges may make it difficult to enter or exit positions.

- Higher leverage increases the risk of liquidation. Adjust leverage settings carefully.

- MWHLabs (mwhlabs.com) assumes no responsibility for any cryptocurrency prices or investment-related information shown on this site.

- All investment decisions are your own responsibility. Please proceed with caution.

Last updated