📍 Hedge Strategy Overview

The Hedge strategy minimizes directional risk by holding both spot and futures positions on the same exchange.

Regardless of whether the coin’s price goes up or down, gains and losses between the positions offset each other—allowing you to earn fixed profits through funding fees.

This strategy is primarily used to generate risk-free returns by taking advantage of favorable funding rates.

📘 How It Works

- A spot position involves actually holding the coin, generating profit when the price increases.

- A futures short position allows you to bet on a price decrease using the same amount of the coin (with leverage if needed).

- If the futures price rises, losses are offset by gains from the spot position.

- When the funding rate is positive, maintaining the short position secures fixed funding income.

🔧 Execution Steps

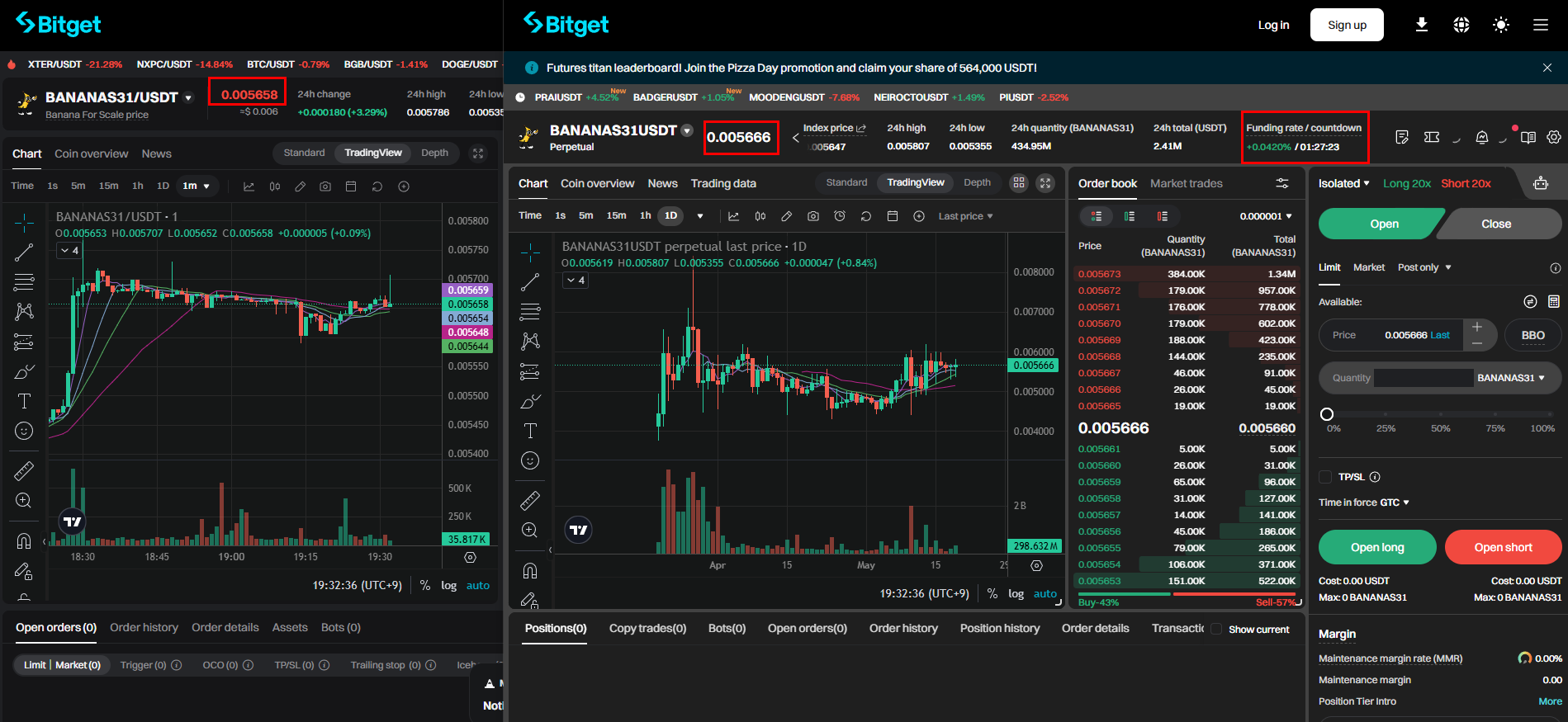

- Open a futures account and deposit funds on a global exchange (e.g., Binance, Bybit, OKX, Bitget, Gate.io) by transferring assets from a domestic exchange.

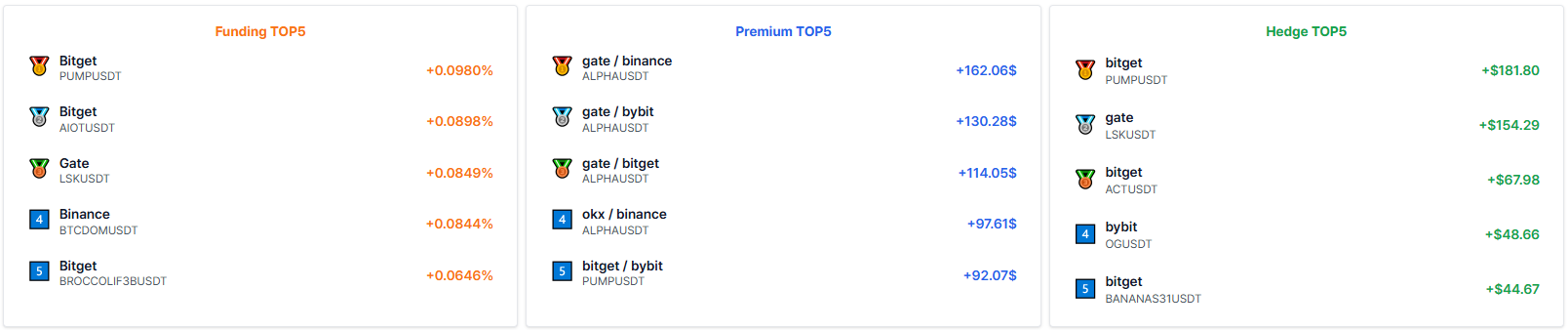

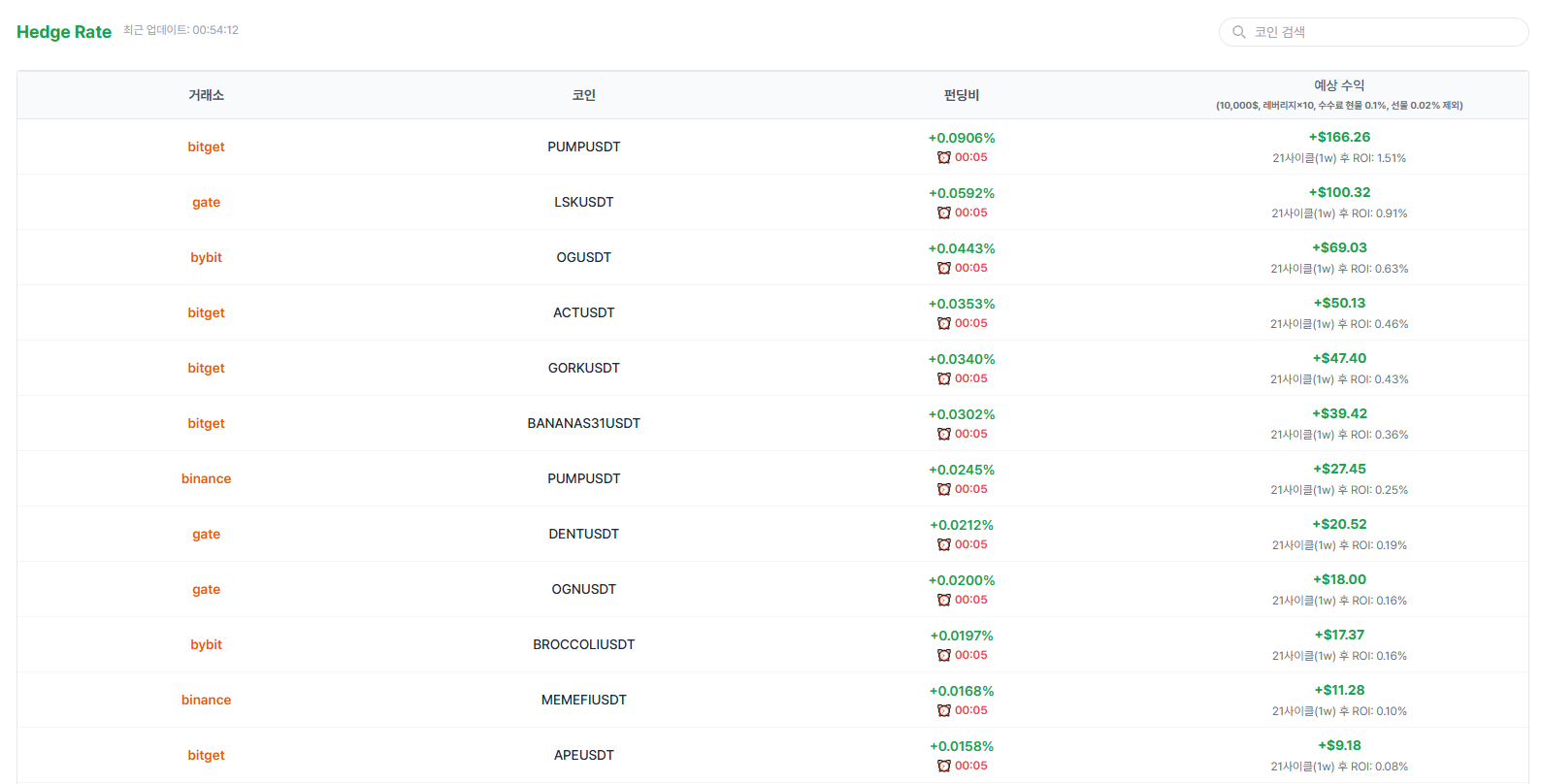

- Visit the Hedge page or Hedge Top 5 section to find favorable funding rates.

- Buy the spot asset, and enter a short futures position with the same quantity (using leverage if needed).

- Hold both positions until the funding payout time to earn the funding fee from the short position.

- After securing the funding profit, close both positions based on your preferred cycle (e.g., 21 cycles = 1 week; sell the spot + close the short).

- The Hedge page provides information such as exchanges, coins, estimated returns, and funding expiration times.

- This strategy is suitable for long-term holding if you’re using a large amount of capital, as quick execution may not be feasible.

- If held long-term, funding rates may turn negative depending on market and exchange conditions.

- Ongoing monitoring and management of funding rates is required when using this strategy long-term.

- Estimated returns assume the current funding rate remains consistent for 21 cycles (one week), but actual results may vary or lead to losses depending on market conditions. Please use caution.

🚀 Recommended Use Cases

- You can buy $10,000 worth of spot assets and use $1,000 in futures with 10x leverage to simulate a $10,000 hedge.

- Even if the spot price fluctuates sharply, profits and losses offset each other, allowing you to earn funding profit stably.

- You can check the Hedge page or Hedge Top 5 section to view opportunities ranked by highest estimated return.

⚠️ Important Notes

- Funding policies and fee structures vary by exchange. Please verify them in advance.

- Estimated returns on the Hedge page are based on a 21-cycle (1 week) period, excluding 0.1% spot and 0.02% futures fees.

- Be sure to include network fees and potential taker fees when calculating your actual profit.

- If the spot and futures positions are not perfectly matched, directional risk may occur.

- Excessively high leverage on futures increases liquidation risk. Adjust leverage appropriately.

- In volatile markets, slippage or unfilled orders may occur.

- Funding rates are subject to change based on market conditions, exchange policy, and trading volume.

- If holding positions long term, continuous monitoring is required. We strongly recommend testing with a small amount first.

- MWHLabs (mwhlabs.com) assumes no responsibility for any cryptocurrency prices or investment-related information on this site.

- All investment decisions are made at your own risk. Please proceed with caution.

Last updated